Standard Chartered Smart Credit Card: 5 Benefits in SG

Introduction to Standard Chartered Smart Credit Card

Standard Chartered is a leading financial institution that offers a range of financial products and services to customers across the world. One of their most popular products is the Standard Chartered Smart Credit Card. If you’re living in Singapore and looking for a credit card that can help you save money and make the most of your spending, then the SC Smart Credit Card is an excellent option. In this blog, we’ll discuss some of the benefits of using this card in Singapore.

Benefit 1: Cashback Offers

One of the most significant advantages of the Standard Chartered Smart Credit Card is the cashback offers it provides. You can enjoy cashback on a range of services, including dining, groceries, and online shopping. Whether you’re looking to dine at your favorite restaurant or stock up on groceries for the week, the SC Smart Credit Card has got you covered. With this card, you can save up to 7% on your dining and grocery bills.

Benefit 2: Easy Payment Options

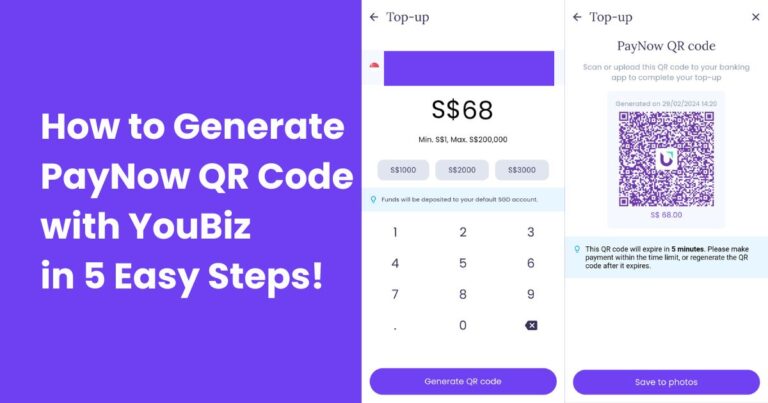

The Standard Chartered Smart Credit Card provides its users with easy payment options. You can pay your credit card bills online, via mobile banking, or auto-debit. This feature not only saves time but also ensures that you never miss a payment deadline, which can negatively impact your credit score.

Benefit 3: Travel Perks

The Standard Chartered Smart Credit Card also offers travel perks to its users. You can enjoy exclusive discounts on airfare, hotels, and car rentals. Additionally, the cardholder can earn reward points for every transaction they make using the card, and these points can be redeemed for various travel rewards. The SC Smart Credit Card is an excellent option for frequent travelers who are looking to save money on their travel expenses.

Benefit 4: Contactless Payments

The Standard Chartered Smart Credit Card comes with contactless payment technology, making it easy and convenient to make payments. With the contactless payment feature, you can simply tap your card on the payment terminal to complete the transaction, without having to enter a PIN or sign a receipt. This feature not only saves time but also reduces the risk of fraud and identity theft.

Benefit 5: Personalized Service

Finally, the Standard Chartered Smart Credit Card provides personalized service to its users. You can enjoy a dedicated customer service team that is available 24/7 to answer your queries and resolve any issues you may face. This feature ensures that you receive timely assistance whenever you need it, making the SC Smart Credit Card an excellent choice for those who value good customer service.

Conclusion

In conclusion, the SC Smart Credit Card is an excellent option for those who are looking for a credit card that offers a range of benefits and perks. From cashback offers to easy payment options, travel perks, contactless payments, and personalized service, this card has something for everyone. If you’re living in Singapore and looking for a credit card that can help you save money and enjoy a range of perks and benefits, then the Standard Chartered Smart Credit Card is the right choice for you.