Resale Endowment Policies (REPs), 4 Easy Steps

Have you heard of Resale Endowment Policies in Singapore?

CNA (Channel News Asia) released a news about a victim who was cheated SGD24,900 by her insurance agent, for fake resale endowment policies.

We are deeply saddened by the news. No one should have his/her trust betrayed by his/her insurance agent. Fortunately the insurance company compensated the victim for her losses.

According to the news, the insurance agent introduced resale endowment policies to the victim, claiming it was available for “Absolute Assignment”.

What is Absolute Assignment?

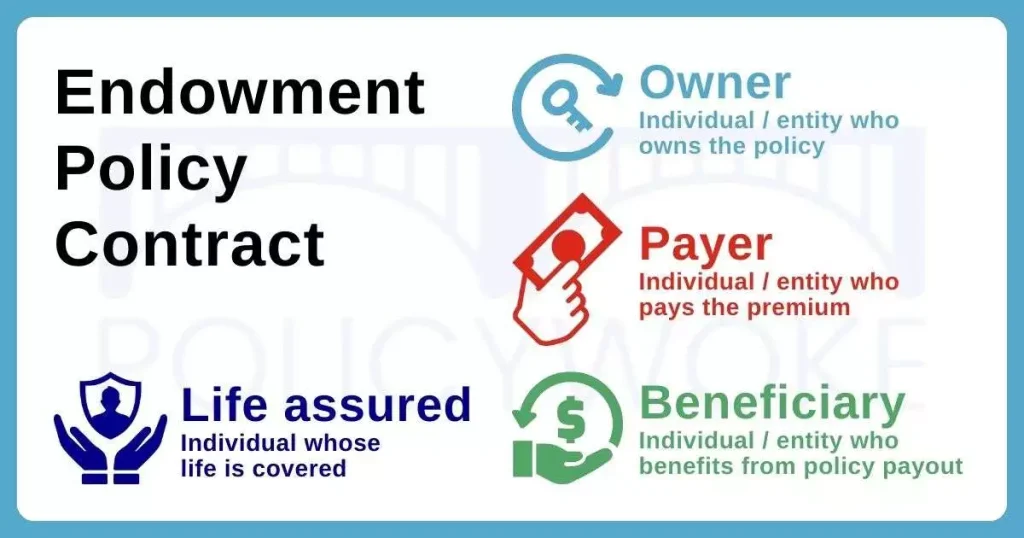

Some of you may be wondering what “Absolute Assignment” is. It means transferring of rights from one person (assignor) to another (assignee). Only the owner of the endowment policy at that point in time can be the assignor. Once the rights have been transferred, the assignee shall be the new owner, new premium payer and new beneficiary of the endowment policy. The life assured of the endowment policy remains unchanged. Prudential has a page with details about this. We would like to take this opportunity to share 4 steps on how Resale Endowment Policies (also known as Traded Life Policies) are being traded.

Supposed we have:

- Helen and Ivan who are 2 unrelated individuals, and they are complete strangers to each other.

- An endowment policy contract which describes the following roles:

Step 1: Buying Brand-new Endowment Policy from Life Insurance Company

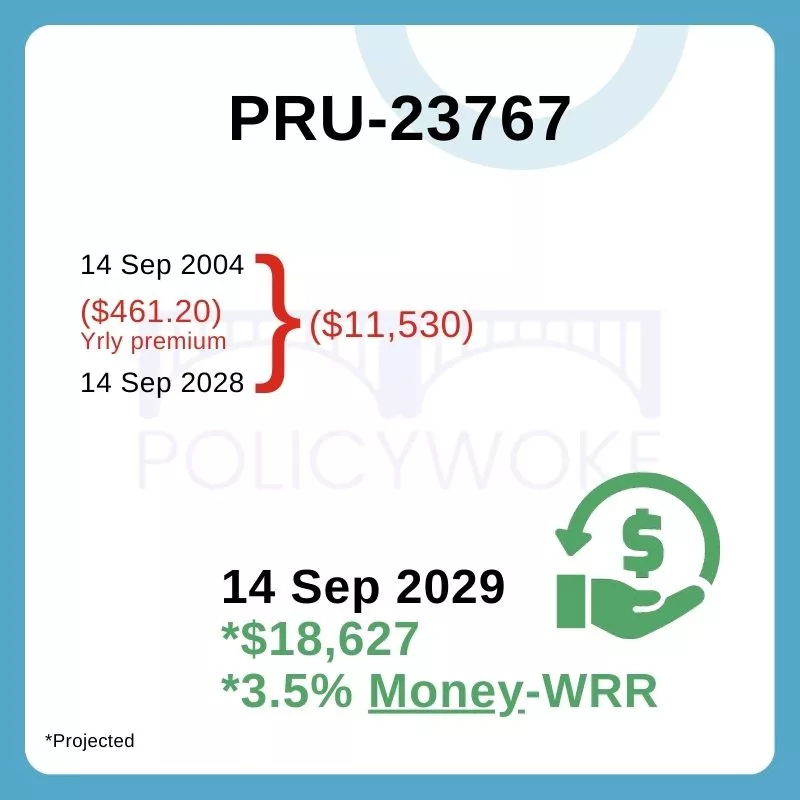

Helen and Ivan had been setting aside funds for their retirement. They had been seeking financial advice on how to grow their savings with minimal risks. In September 2004, after seeking advice from their respective financial advisors, Helen decided to buy a 25-year endowment policy to grow her savings towards her retirement target. Whereas Ivan decided not, as he felt that 25 years was too long for him as a commitment, and he preferred to split that 25 years into multiple shorter ones. The endowment policy information is summarised as follows:

After Helen had bought the endowment policy, the contract would look like this:

Step 2: Selling Endowment Policy to Broker

In October 2021, after paying 18 years of premium, Helen wanted to give up her endowment policy due to a change in her retirement target. She came across PolicyWoke, Singapore traded endowment policies specialist (Steps), that offers higher cash back than if she were to surrender it to the life insurance company.

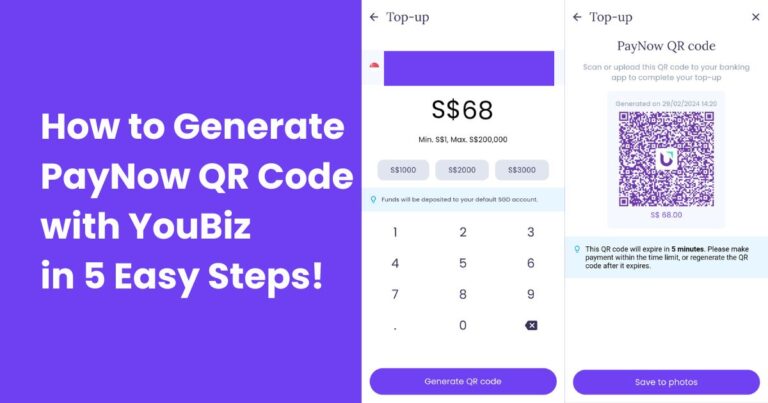

After submitting quotation request and then accepting PolicyWoke’s offer, she would made a trip to the life insurance company’s customer service centre with PolicyWoke to do the “Absolute Assignment” paperwork for the endowment policy hand-over. In this “Absolute Assignment” instance, the assignor is Helen and the assignee is PolicyWoke. Once the paperwork had been done, PolicyWoke would transfer funds equal to PolicyWoke’s offer price to Helen via PayNow or FAST (Fast and Secure Transfer).

After PolicyWoke had taken over the endowment policy from Helen, the contract would look like this:

The endowment policy was then put up onto the website as resale endowment policies, with the information summarised as follows:

Step 3: Buying Resale Endowment Policy from Broker

In October 2021, Ivan was still having his retirement target in mind. He seemed to regret not buying an endowment policy back in September 2004 . However, he chanced upon the REPs list on PolicyWoke’s website and saw resale endowment policies as an opportunity for his retirement target, since he did not buy a brand-new one back then. The resale policy on the website had an attached policy illustration as proof of existence and ownership, and it is available for transfer via “Absolute Assignment”.

Whereas according to the CNA news, the insurance agent did not produce document proof to show resale endowment policies’ existence and ownership to the victim.

After Ivan had transferred funds equal to the resale price to PolicyWoke via PayNow or FAST, he would made a trip to the life insurance company’s customer service centre with PolicyWoke to do the “Absolute Assignment” paperwork for the endowment policy hand-over. In this “Absolute Assignment” instance, the assignor is PolicyWoke and the assignee is Ivan.

Whereas according to the CNA news, the victim had transferred funds to the insurance agent, which should not be the case as the insurance agent was not the owner of resale endowment policies at that time. Also, there is no indication that the insurance agent had made an arrangement for the victim to meet the policy-owner at the life insurance company’s customer service centre for the paperwork.

After buying existing endowment policy, the contract would look like this:

Step 4: Holding Resale Endowment Policy to Maturity

The endowment policy did not have any riders attached to it, as they would have been removed if any, back when PolicyWoke took it over from Helen.

For Ivan to meet his retirement target, as he is the premium payer in addition to him being the owner and the beneficiary, he had to continue servicing his endowment policy till it matures in September 2029 .

In normal cases, if Ivan kept servicing his endowment policy till maturity, he would receive the maturity pay-out.

What if Helen Passes On before Endowment Policy Matures?

It depends on whether her passing was then reported to the life insurance company.

If her passing was indeed reported to the life insurance company, then the life insurance company will contact Ivan to collect the endowment policy’s death benefit, and the endowment policy would then be terminated.

Otherwise if no one reports her passing to the life insurance company, the endowment policy would continue to be in-force as though Helen was still alive.

What if Ivan Passes On before Endowment Policy Matures?

The endowment policy will go to the Estate of Ivan’s.

Conclusion

We hope the above-mentioned 4 easy steps on resale endowment policies help you understand better on how it works.

Take care, and stay safe.